Marketing Automation is More Than Your Onboarding Process

Lots of financial institutions use automation for their onboarding process. Think bigger and expand your relationship with marketing automation using these examples.

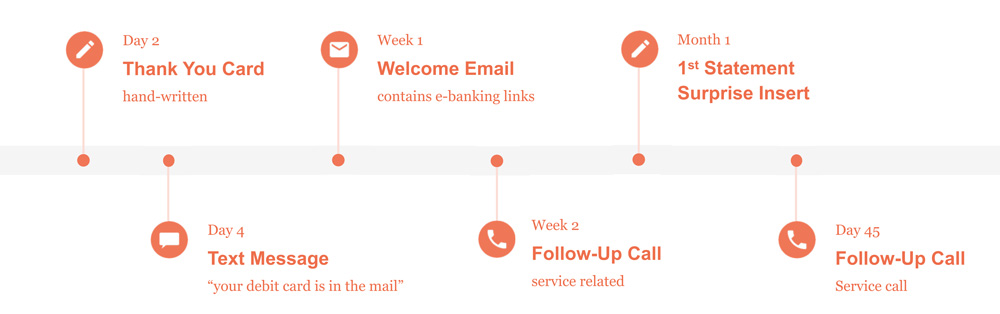

Using marketing automation in the onboarding process is important and a common application of it. So much so, that many banks think that it is its only application. In reality, it can be so much more than onboarding.

With the individual customer data that a good CRM provides, marketing automation can bring the power of that personal knowledge to large-scale communications. Triggering different types of personal communications or other events across multiple customer records is the larger power of marketing automation. Applied with skill, not only can you streamline onboarding, but you can also make a positive measurable difference in overall customer retention and growth.

You should be using the power of the marketing automation tool to talk smarter to your customers. This means knowing who they are, what they want, and when to talk to them about it. Good examples of the types of beyond-onboarding capabilities to consider include,

Targeted Cross-sell Campaigns

Increase growth with simple but targeted cross-sell campaigns. Use the marketing automation tools to identify and segment your current customers who may be interested in a particular product—like offering a credit card to certain checking account holders. Using your customer data to narrow your audience and target the right customer gives you the power to talk to the customer most likely to be interested in your product or service.

Retention-Focused Communications

Increase retention by creating marketing campaigns focused on certain segments of your current customers. For example, you can identify your top customers and automate touch points like an email or a phone call for a personal check-point regarding general satisfaction or specific needs. You can create automated trigger marketing campaigns in which customers whose account balance goes over a certain amount automatically enter the campaign and receive communication regarding a more appropriate account. This level of personal, targeted service to current customers is a valuable indicator of your relational focus.

Power of Segmentation

Segmentation is a powerful step in marketing automation that you should be using to locate your ideal customer, whether current or prospective. Understanding the specific characteristics of the customer most likely to be interested in applying for a home equity line of credit, for instance, is an important first step. Using segmentation to find that customer within your customer data set is the reliable road to increasing the success of your automated marketing campaign. Most high-response campaigns begin with an intelligent segmentation of customers most likely to participate in an offer, so be sure your institution’s marketing tool makes creating your own segmentation lists easy and accessible. The value in creating and controlling your own data is worth the extra in-house effort.

Tracking Feedback

Tracking and measuring is asking one basic question: “How did we do?” Answer that question by measuring campaign results against the campaign’s initial goals. You can also do comparative measuring between multiple campaigns. Reporting features can then interact with your automated campaign results and provide post-campaign data, very useful for not only seeing successes and misses, but also for determining campaign design improvements. In the most practical sense, tracking campaign performance completes the loop on the journey to ongoing progress. It’s surprising how many institutions leave this step out or skimp when gathering this data, but tracking and measuring the results of your marketing efforts give you a sound foundation for the next marketing campaign.

For more information on marketing automation, including more applications and more practical examples of its use, fill out the form below to get the full paper.